It is still uphill in Spain. In all these years of economic crisis that we are going through, I am surprised that I find few voices explaining what is really happening with the State Accounts.

The solvency or not of these accounts is what will allow for a better or worse future for Spain and the Spanish people.

The only person I have been able to discover who consistently takes a critical look at those accounts is Roberto Centeno.

It seems somewhat evident that monetary systems, for approximately one hundred and fifty years, have been established, grow and fall in periods varying between thirty and forty years. From 1871 until World War I, the world was based on the classical gold standard. Between the two World Wars a gold exchange also operated. During all these years, the trade protectionism of the different states prevailed above all. But at the end of World War II the model was changed.

The idea was to establish a free trade policy. It was understood that this would be the most solid basis for establishing foreign relations. It was a theory that strongly supported the needs of the United States of America, which had been the great winner of the two great wars.

"...It had a powerful manufacturing industry and became rich by selling arms and lending money to the other combatants. The industrial production of the USA in 1945 was more than double the annual production of the years 1935-39. The USA accounted for about 50% of the world's GDP and had less than 7% of the population. As the largest world power and one of the few nations little affected by the war, it was in a position to gain more than any other country from the liberalization of world trade.…"

In the hotel complex of Breton Woods (New Hampshire), the world's leading states met for nearly a month and established the new parameters that were supposed to guide the world's growth.

It worked until 1971. Beginning in 1971, the United States decided to abandon the gold standard. Problems with the price of oil and the enormous expenses in Vietnam led President Nixon to make that decision. Since then the world has been governed by the standards set by the US dollar.

More than forty-five years have passed.

It is interesting to reproduce two related articles published by Marco Antonio Moreno in Blog Salmón.

"Until a few years ago, countries tried to maintain a certain balance between exports and imports of goods. Most countries were concerned with exporting more than they imported and with the difference, they accumulated gold reserves. After Breton Woods, they began to accumulate reserves in U.S. dollars and these dollars could be exchanged for gold.

The abandonment of the gold standard on August 15, 1971 is closely linked to the massive unemployment in industrialized countries.. Until that date, the dollar was the closest thing to goldIn the last few years, the world economy was in a state of crisis, and all nations tried to maintain a constant balance between their exports and imports of goods. Most countries devised alternatives to export more than they imported, so as to accumulate reserves of gold or, failing that, U.S. dollars which, according to the 1944 Bretton Woods treaty, could be exchanged for gold.

Thus, of the more than 20,000 tons of gold that the United States had at the end of World War II, year by year it decreased as many countries (especially France) insisted on exchanging dollars for gold. This situation came to a crisis in 1970 with two unexpected phenomena for the U.S. government: the arrival of the oil pickup (a situation that forced the United States to import oil, when until then it had been exporting oil) and the adverse results of the Vietnam War. Both events wiped out the U.S. gold reserves and the country went bankrupt.. The advantage he had to disguise his bankruptcy was clear: owning the dollar printing press.

In the first months of 1971, Henry Hazlitt and Paul Samuelson recommended to Richard Nixon's government that the dollar would have to be strongly devalued since it would be necessary to increase the number of dollars needed to obtain one ounce of gold from the U.S. Treasury. But Nixon did not take Hazlitt and Samuelson's advice into account, because he followed Milton Friedman's indications, who suggested the idea of letting the dollar float freely and eliminating the dollar's convertibility into gold, given that the international currency was worth the very backing offered by the U.S. government, the world's economic locomotive. Thus it was that on the morning of Sunday, August 15, 1971, Richard Nixon declared the inconvertibility of the dollar into gold, and unilaterally ended the Breton Woods agreement..

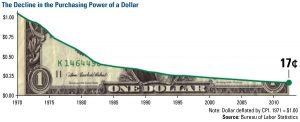

From that moment on, all world trade was carried out using dollars printed by the U.S. Treasury, which is nothing more than fiat money, or simple paper money. If until then, international trade was valid because it was backed by gold, from then on it began to depend on a fiat currency, produced by the largest printing press in the world. The consequences of that fateful day were that all the countries (that could) began to accumulate dollars, as the credit expansion of the United States advanced unchecked and now without the restrictions imposed by Breton Woods. The rest of the world was forced to accumulate dollar reserves and these reserves had to be always growing, since at the slightest sign that a country's reserves were falling, monetary speculators would wake up and attack that country's currency and destroy it with a strong devaluation.

The growing flow of dollars to all parts of the world fueled the expansion of global credit, which only stopped in August 2007, after exhausting all instances of what we have called ponzi scheme. The international banking elite always strove to devise mechanisms to obtain greater profits and for this purpose always sought to expand credit. A credit that was freed from the restriction of having to pay international bills in gold, and which marked the commercial boom in the United States.

Until the 1970s, a poor country like China had no influence on world trade: it sold little and bought little from the rest of the world. The globalization of the 1980s, facilitated by this expansion of counterfeit money, offered great facilities to companies which, in search of cheap labor, set up their factories in China. This was the beginning of the deindustrialization process that started in the United States and continued in Europe. A process that destroyed the largest number of jobs in the industrialized countries and became a path of no return ... The origin of financial chaos and global unemploymentThe results of this study are even more evident when we complement them with the reports of The material causes of the crisis.

The chain of events is eloquent: after World War II, the United States became the dominant economic power with the clear advantage of using its own currency in world trade. This advantage became absolute after the decision of August 15, 1971. But it was an advantage which was abused and which today has it on the verge of bankruptcy.

There is no doubt that free trade is beneficial for all mankind: it is good to be able to buy goods at a more convenient price and to practice exchange. Each country has its own advantages which it must strengthen in order to produce what it is most efficient at. The whole world can benefit from this practice which induces each country to produce that in which it has comparative advantages. It is a very attractive doctrine which, however, has a fundamental problem: it was conceived for a world where the means of payment was gold.

As I pointed out in The Origin of Financial Chaos and Global Unemployment, the notion of free trade was established when the gold standard existed, which obliged to maintain the structural equilibrium of trade. Thus, every country that wanted to buy, had to sell, as indicated by Say's Law: supply to demand. Under the gold standard, it was not possible to sell to a country that did not buy. Trade was naturally balanced by this restriction.

For example, at the beginning of the last century, Colombia and Mexico were able to export coffee to Germany because Germany, in turn, sold machinery to Colombia and Mexico. Germany bought Colombian coffee because Colombia was in turn a client of Germany. Each operation denominated in gold produced as a result an equilibrium based on each country's own economic reality. And since equilibrium was central to the relations between countries, a small amount of gold was enough to adjust the balance.

For this very reason, the United States sold and bought very little from China. The Chinese were poor and lacked purchasing power, and although Chinese goods were cheap, the U.S. could not afford to buy too much because China could not afford to buy U.S. goods, since it had other priorities. Trade between China and the United States was balanced by the need to pay the balance of their transactions in gold. Balance was imperative. There was no possibility of structural imbalance.

With Free Trade under the gold standard, the vast majority of transactions did not require gold movements to complete the exchange: goods are exchanged for other goods, and only small balances are settled in gold. In this way, international trade was limited by the volume of mutual purchases between the parties, e.g., Chinese silk paid for U.S. imports of machinery, and vice versa.

All this changed when Richard Nixon eliminated the convertibility of the dollar into gold on August 15. From that moment on, everything could be paid in dollars and the United States could start printing as many dollars as it wanted. So it was that in the 1970s, the U.S. began to buy large quantities of goods from Japan. And the Japanese boasted that they were selling and not buying, a situation that was impossible under the gold standard.

But what was impossible under the gold standard became perfectly possible under the dollar monetary framework. In this way the Japanese became gigantic producers and transformed the island of Japan into a huge factory. Japan accumulated huge reserves of the dollars sent by the United States in exchange for the products, giving rise to enormous structural imbalances. This process increased the gradual deindustrialization of the United States that we have already seen in The Material Causes of the Crisis.

One of the examples where this deindustrialization process can be seen is in the manufacture of television sets. Since the 1930s, and with the pioneering work of Jenkins and Sworykin, this industry became strong in the United States with brands such as Westinghouse, Philco and Motorola, which between the 1970s and 1980s would be surpassed by the Japan Victor Company and Sony. Another case is offered by the steel industry, as we pointed out in Some key free trade mythsThe abandonment of the gold standard allowed the Japanese to sell without having to buy, and the United States to buy without having to manufacture. The result was that many U.S. industries closed because of the end of the gold standard. The case of the automobile industry is emblematic: today the city of Detroit is a sample of tourism for archaeologists.

The end of the Bretton Woods agreements, which mandated structural balance of payments equilibria, brought with it the onset of structural imbalances, which were initially camouflaged by the access to credit provided by Washington. The United States embarked on a large-scale expansion of credit, and as the economy destroyed jobs in industry, the financial sector provided access to credit that camouflaged the stagnation and stimulated imports from Asia, which further depressed U.S. industry. It is no coincidence that in real terms US workers have had no real increase in their incomes since 1970.

At the time, the vast majority of economists, led by Milton Friedman, considered the elimination of the gold standard perfectly acceptable. The boom in credit expansion and consumption was viewed favorably and structural imbalances were seen as transitory. They never thought about the unintended consequences of unbridled consumption that would lead to the consumption of half the GDP and accumulating a debt of four times its GDP. Nobody foresaw that the enormous advantage acquired by the United States (buying in the world with its own currency) could become a fatal cause of industrial destruction and massive unemployment. This was logical: this great failure went unnoticed if the rate of growth made it possible to camouflage the imbalances.

But the credit expansion has ended and in its place there is credit contraction and lack of liquidity. Now structural imbalances and massive unemployment are becoming more relevant with each passing day. What can be done to increase employment and boost demand in order to give an impetus to economic reactivation? No one wants to answer this question because correcting these imbalances requires reversing the very process of globalization and re-industrializing what was destroyed. Only job creation can stop the crisis and this will necessarily imply resetting a large part of the globalization process."

But this largely does not apply to Spain. Spain does not have the machine to print the tickets that others then take as reserves.

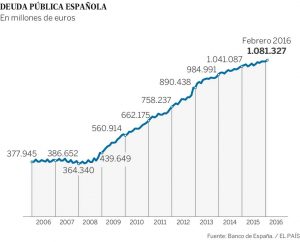

In Spain we need to get into debt to pay the ever-increasing deficits. The worrying thing is that there will be a day when nobody will be willing to lend to Spain. The ability to pay will not be credible.

It happened to Greece already within the European Union, it could happen to Italy and it has happened to countries much richer than Spain.

I believe it is worthwhile to extract a little from the last article by Mr. Roberto Centeno:

"...Since 2007, the debt has increased more than three times -133,000 euros is already owed by the average family, wages have fallen by 20%The wealth of families has been reduced by 40%, a third of the middle class has been destroyed, the jobs created are temporary and wages are so miserable that, as Brussels itself says: "Employment in Spain no longer guarantees a way out of poverty..

"The deficit target does not exist."

The previous sentence, pronounced on Thursday by Montorosummarizes what we already know: that the figures and budgetary promises of the PP are not worth the paper they are written on. Therefore, the most relevant aspect of these Budgets, because that is the only thing that is fulfilled -the brutal increase in political waste- is that they make permanent 250,000 employees who were hired by the trade unions among their relatives and friends, mainly in Health and Education, to cover the scandalous absenteeism -four times higher than in Europe-, more 40,000 to be collected by Susana Díaz 67,000 more (where only police, civil guard and little else is needed).

An additional expense of 11,000 million Euros per year -because absenteeism will remain the same and new temporary employees will be hired- which is added to the waste of more than 100,000 million Euros represented by the autonomous State. Spain is the second country in Europe that more pay for public employees after Luxembourg, 44.3% more on average than private sector workers, who pay for the whole party, being, at the same time, the country with the greatest social inequality in Europe. Then, the coward Rajoy, instead of applying art. 155 and prosecuting the seditious ones, gives 4 billion for infrastructures in CataloniaThe only region in Spain that has all its capitals connected by AVE (high speed train).

And without blushing, they put the spending ceiling at 118,337 million, 5,000 million less than in 2016. To whom are they going to take away what the new plugged-in and seditious people cost? To the pensioners, to the unemployed, to the dependents? And then they talk about a strong increase in collection with all its face: 200,963 million, a 7.9%, less growth than in 2016, where the collection increased only 2.3%. They say that due to inflation they will collect more VAT and personal income tax (hiding that they will lower pensions by 1.5 billion), but. 1.5% of the two is 2,000 millionand up to the 14,000 needed? Montoro says that the fact that tax revenues are higher today "is the guarantee that the deficit will be met". In March 2016, the Tax Agency said that "tax revenues were 5.6% higher", and what happened at the end of the year? They went up by only 2.3%.

…

But all these tricks do not matter, because as Cristóbal, the smartest minister in the Government, knows very well, the only relevant thing about the Budget is that it is approved, all the rest is exactly the same. That is what the debt is for; in January alone they have increased it by 7,800 million. If it is for money! And as they already have the useful fools to get them ahead, and also enthusiastic, and the AIReF sellouts to certify the lie, if the figures do not add up, who cares?..."

Worrying.

Back to the beginning: we are still going uphill in Spain. And it seems that we are not realizing it and its consequences.

A mastodon is being built that consciously knows that it will have no other way out but to collapse. And it seems that everything is being prepared so that when it collapses, it will do so in the hands of others.

It might seem that the selective memory of the citizens is being played with. Those who created the mastodon will not be around when it collapses. They may be called as "saviors".